The timeline to reregistration

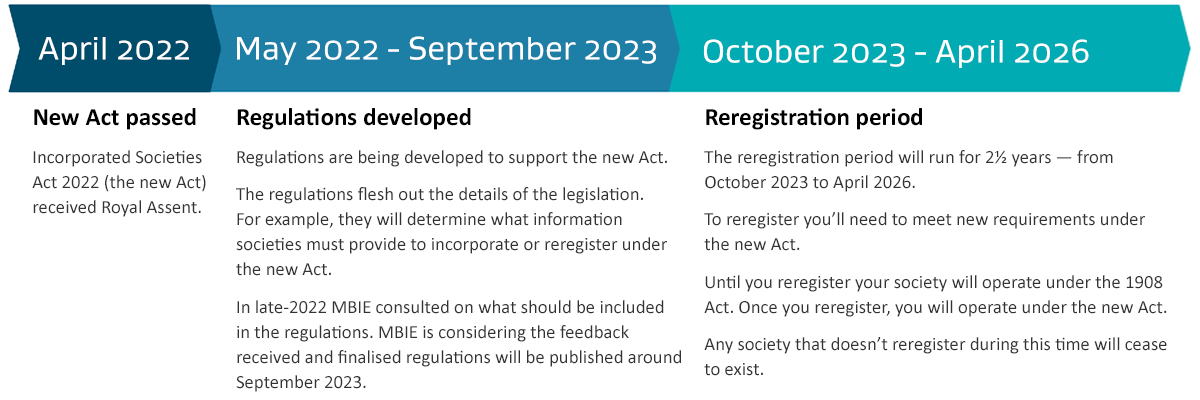

The Incorporated Societies Act 2022 (the new Act) was passed on 5 April 2022 but it will be some time before societies need to reregister.

Between now and then, there are a number of different things happening. The next step involves developing the regulations that will support the new Act. Once the reregistration period begins, societies will have 2½ years to reregister, from October 2023 to April 2026. This means for a time there will be societies operating under the new Act and others operating under the Incorporated Societies Act 1908.

Regulations are in the works

Regulations to support the new Act will determine some of the details of the new regime, such as how your society will apply for reregistration and what penalties your society would face if it breached its obligations.

The Ministry of Business, Innovation and Employment (MBIE) sought feedback on what regulations should be made . Consultation has now closed and MBIE is considering the feedback received. The finalised regulations will be published around September 2023.

Developing the regulations

MBIE prepared a discussion document outlining proposed regulations that flesh out the details of the new legislation. For example, they include:

- the information societies will need to provide to us when applying for incorporation of a new society or reregistration of an existing one.

- the criteria for determining which societies will need to have their financial statements audited by a qualified auditor

- what information will need to be provided in the annual return

- the level of fines that can be imposed on societies that fail to meet their legislative obligations.

We'll continue to provide regular updates here on our website.

Reregistering under the new Act

The reregistration period will run for 2½ years — from October 2023 to April 2026. Any society that doesn't reregister during this time will cease to exist.

Closer to the time we will provide you with detailed information on what's involved in reregistering.

Until they reregister, societies will operate under the existing legislation — the Incorporated Societies Act 1908. Once they reregister, they will operate under the new Act.

Related information

- Information on the MBIE website about the Incorporated Societies Act review

- Copies of the legislation - the new Act Incorporated Societies Act 2022 and the existing legislation Incorporated Societies Act 1908.

How you can stay up to date

We will update the information here on our website throughout the transition period. You can also choose to receive updates from us directly to your inbox. Alternatively, you can follow us on Facebook.

Sign up to receive updates from us Follow us on FacebookIf you have any questions or comments about these law changes, you can email us at engage@societies.govt.nz.

Published 18 May 2022, updated 19 January 2023